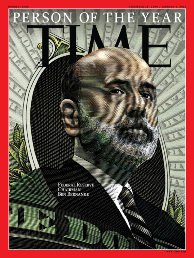

Time – Person of the Year

Ben Bernanke is named Time’s Person of the Year after serving as Chairman of the United States Federal Reserve during the country’s financial crisis of 2007–2008. Runners-up for the honor are commander of U.S. forces in Afghanistan Gen. Stanley McChrystal, the Chinese worker, U.S. Speaker of the House Nancy Pelosi, and Jamaican sprinter and Olympic gold medalist Usain Bolt.

Ben Bernanke is named Time’s Person of the Year after serving as Chairman of the United States Federal Reserve during the country’s financial crisis of 2007–2008. Runners-up for the honor are commander of U.S. forces in Afghanistan Gen. Stanley McChrystal, the Chinese worker, U.S. Speaker of the House Nancy Pelosi, and Jamaican sprinter and Olympic gold medalist Usain Bolt.

Managing Editor Richard Stengel explains the magazine’s choice: He was the great scholar of the Depression who saw another depression coming, and did everything he could to stop it. He is influencing how the economy operates.

Testifies before Senate Banking Committee

Yellen offers insight into the economy and central bank policy to members of the Senate Banking Committee. Yellen also defends the Fed’s independence as she faces questions from lawmakers interested in limiting the authority of the central bank. Sen. Jeb Hensarling, R-Texas, chairman of the committee, suggests that weekly discussions between Yellen and Treasury Secretary Jack Lew be publicly disclosed. Yellen opposes the suggestion.

I’m not willing to report, on a weekly basis, private conversations.

Economy expands

The Federal Reserve reports in its Beige Book that consumer spending, manufacturing and job growth are expanding in all of its districts. Five of the 12 Fed districts note “moderate” growth, while the other seven see “modest” expansion.

Most districts were optimistic about the outlook for growth.

The Fed report finds that price pressures are largely contained, but notes higher prices for construction materials, meat and dairy products.

Bond-purchase tapering continues

0 CommentsThe Federal Reserve announces that it will continue to reduce its monthly bond purchases. The central bank has reduced its bond buying from a monthly rate of $85 billion to $25 billion. The Fed gives few hints as to when it will increase interest rates. However, it suggests it will maintain the federal funds rate at near zero for awhile after it concludes its bond buying.