Rolling Stone profile

Rolling Stone publishes a profile of Karpeles and Mt. Gox, titled The Rise and Fall of a Bitcoin Kingpin. On stealing Gameboys and mobile phones as a teenager by hacking shopping websites:

A lot of people respected me for that. I did feel more important, in a way. If I need something, I press a button and I get it.

On what he felt like when he realized $650 million in bitcoins were gone:

It really felt unreal. I don’t know how to describe that. When you get a hospital operation without any anesthetic, it hurts at first, but at some point the pain reaches a point where you don’t feel anything anymore.

Arrest warrant for $2.6 million bitcoin theft

After three weeks with no formal charges Japanese police says they will issue a fresh arrest warrant accusing him of pocketing $2.6 million worth of Bitcoin deposits, which was mainly spent on buying software rights, but also includes $48,000 for a luxury bed. Police are also reportedly interested in questioning Karpeles about the disappearance of 850,000 coins worth 48 billion yen last year. They were valued at around $480 million at the time of the disappearance, and $387 million at current exchange rates.

Bankruptcy deadline extended

The bankruptcy trustee extends the period for filing bankruptcy claims from May 29, 2015 until 12 noon July 29, 2015. After July 29, the only things that a user will be able to do through the online method will be to view bankruptcy claims filed by the user and transfer the bankruptcy claims to another person.

Bankruptcy claim system opens

A notice (link) posted on Mt. Gox’s website, says customers can make bankruptcy claims by signing with their account at claims.mtgox.com. There is also an offline option. Those filing must sign up to, or already have, a Kraken account since any returned coins will be deposited via the service. Returns will be calculated at a rate of $483 per BTC with an additional 6 percent per annum. Mt. Gox customers have until May 29 to file their claim. The company’s creditors plan to make a decision on returns by September 9, 2015.

Kraken to handle bankruptcy claims

The bankruptcy trustee for Mt. Gox announces it will work with California-based Bitcoin exchange, Kraken, to return the money left in the estate to the company’s 127,000 creditors. Kraken CEO Powell says the company will help with the claims process, including evaluating the assets owed to creditors, and that it will assist in the investigation of Mt. Gox’s collapse. He says the trustee will have the final decision on payments in Bitcoin:

Allowing the creditors to go on without reinvestment, I think, would be very wrong. We’ve got to have the money that was locked up for the last 10 months returned as soon as possible.

On whether the exchange should be revived:

There are no assets, no brand. There is nothing to speak of to revive.

PC World interview

Karpeles agrees to an interview with PC World on the condition that he will not discuss other than in general terms what happened at the company, the police investigation into it and other litigation involving him. He says Tibanne now has 13 employees and still does Web and server hosting as well as Web and mobile application development. Tibanne’s graphics editing software subsidiary, Shade3D, has about 10 staff.

I’ve been trying to keep Tibanne and Shade3D running well so we can maybe assist with the Mt. Gox bankruptcy…I cannot apologize enough for what happened. While I believe I did everything I could do to prevent this from happening, it still happened. Right now, I’m trying to do my best to cooperate with the bankruptcy process and the ongoing investigation.

Karpeles says Bitcoin needs the kind of physical security measures that are used to protect gold, including 24-hour operation centers manned by guards and accessed only through hardware tokens, with staff who have undergone extensive background checks.

[Without major investments in security infrastructure] most likely we’re going to see more companies getting hacked, or bitcoin being stolen.

Karpeles interview

Karpeles is interviewed by Tokyo-based journalist, Nathalie Stucky. On whether the Japanese police have enough knowledge to investigate Mt. Gox:

I think that those who think that the Japanese police is “incapable” slightly underestimate them if they think that they are not advancing. I don’t have all the details, but I have more details than usual people. So I have seen things that others won’t ever see. And based on that, I think the Japanese police are quite efficient. But I totally support the idea that several people start their own investigations. It is generally a good idea to have different people having different way of seeing the same problem. The police does not report into details on what they are doing, that’s why it might seem like they are not doing anything but they are actually working on this. As for understanding the situation, I think I gave them enough training so that they can now go on. It is a recurrent fact that the Japanese police arrest innocents and make them confess that they did the thing. So, I simply hope that they won’t do anything insane. That is something that is not guaranteed though.

A question he wishes people would ask:

I wished that someone had asked me how I’m doing. I think everyone sees me as “Mr. Mt Gox,” and not enough like a human being, or just a person. Although I don’t always agree with what human beings think, or the way they react, it’s sometimes disappointing, everyone needs human interaction.

Karpeles WSJ interview

The WSJ interviews Karpeles at his home on the top floor of a 33-story building in Tokyo’s Meguro neighborhood. It is first media interview since a news conference when Mt. Gox filed for bankruptcy in February.

All I can say is I am deeply sorry. But I did what I could, and I swear I haven’t been doing anything too luxurious.

On security:

We had some cases where a stranger sneaked in and took things away. We also have at least one former employee stealing the company’s data.

On what he had done wrong:

Management. I was too busy and couldn’t lay out an adequate corporate structure. I wish I had five of me, as I was too busy with meetings with banks, lawyers and business partners. That was all painful, I wish I had more time to do engineer-type of work. We tried [to hire experienced professionals] but we didn’t have money and also often they turned us down.

Asked when he found out the Bitcoins were gone:

I always worried about ‘What if all the bitcoins were gone?’ Since that actually happened, I have gone through many sleepless nights. Scared, frustrated and angry—-so many emotions were occupying my mind.

He wishes someone should buy the exchange and says that Bitcoin has the potential to change the world but is too easy to use for illegal activities.

McCaleb never met Karpeles, lost “around $50,000” in site collapse

The original founder of the site explains his relationship with Karpeles in an interview with Ars Technica.

I met [Karpeles] I think on bitcointalk.org. The Bitcoin community was very small at that time and I asked him to do some software development for me. He did that task and I was looking for someone else to run Mt. Gox so I could focus on other things. We discussed the possibility of him buying Mt. Gox from me and I ended up selling it to him in 2011.

I have not had any involvement with Mt. Gox other than as a minority shareholder since early 2011 when I sold it to Mark Karpeles, whom I have never even met in person,” he said. “It is my understanding that Mark also rewrote the entire codebase sometime in 2011 shortly after the sale and none of my code remained in use. Aside from the sale, I have never received any distributions or profits from Mark

McCaleb also tells Ars he lost around $50,000 (held in dollars, not bitcoins) when the exchange closed.

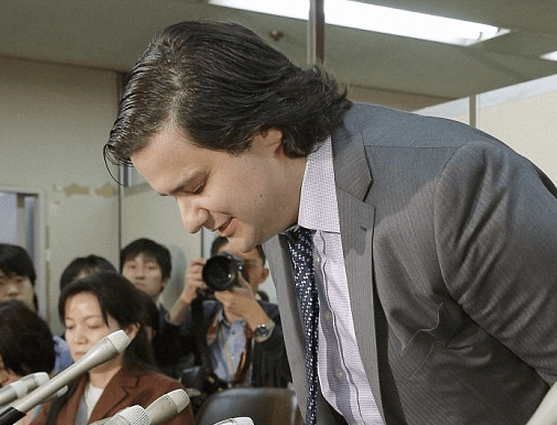

Karpeles apologizes on Japanese TV

Karpeles appears before Japanese TV news cameras in Tokyo, bowing deeply for several minutes.

Ver: Problems caused by banking system

After meeting with Karpeles, Ver makes a video statement:

Today I’m at the Mtgox world headquarters in Tokyo Japan. I had a nice chat with MTGOX CEO, Mark Karpeles, about their current situation. He showed me multiple bank statements, as well as letters from banks and lawyers. I’m sure that all the current withdrawal problems at MTGOX are being caused by the traditional banking system, not because of a lack of liquidity at MTGOX.

Reuters interview

Reuters interviews Karpeles, who while sitting on a big blue ball, explains that the currency needs more merchants to adopt it so it can grow,